Right Now

It’s Christmas time for special interests in Washington and Congress is playing Santa. The tax extenders package the Senate will pass this week is a congressional Christmas tree full of goodies for everyone from Wall Street to Sunset Boulevard. Tuna companies, race horse owners, luxury hotel developers, and Hollywood movie makers are just a few of the groups on Congress’ nice list this year.

This week the Senate will extend more than 50 special tax expenditures that expired at the end of 2013, adding more than $41 billion to the debt over the next ten years. H.R. 5771, Tax Increase Prevention Act of 2014, is another reminder that Congress continues to fail in its promise to overhaul the tax code, which is full of handout for the well-off and well connected.

“This bill represents the worst habits in Washington. Politicians in a lame duck, end-of-the-year session, passing out goodies to well-connected industries instead of lowering tax rates for all Americans.” said Senator Coburn. “For each of these that benefit only one company or industry, other taxpayers must pay more. It’s unfair system that benefits only a few at the expense of everyone else.”

“Congress must stop the perpetual temporary extensions of wasteful tax breaks, and make the tax code flatter and fairer for all taxpayers.”

Last week, Dr. Coburn released a 320-page expose, Tax Decoder, which decodes the tax code. The report describes more than 165 tax expenditures worth over $900 billion this year and more than $5 trillion over the next five years. Many of the extenders in the package today are detailed in the report. See the attached spreadsheet for more details on each provision.

Dr. Coburn filed 12 amendments to the extenders legislation, including amendments to strike the extension of the New Markets Tax Credit, which gives Wall Street banks nearly $1 billion annually in tax credits. Other amendments would strike a special tax credit for railroad track maintenance, eliminate the NASCAR tax break for owners of motorsport race tracks, and eliminate tuna tax break, among others.

Dr. Coburn's amendments to tax extenders are here.

Dec 16 2014

Coburn Introduces Bill to Protect and Strengthen the Social Security Disability Insurance Program

(WASHINGTON, D.C.) – The disability trust fund will be completely exhausted in less than two years, according to the Social Security Board of Trustees. When this happens, the more than 11 million Americans receiving disability benefits will face immediate cuts of nearly 20 percent, unless Congress acts soon.

Today, U.S. Senator Tom Coburn, M.D. (R-OK) announced the introduction of S. 3003,the Protecting Social Security Disability Act, a bill to improve the integrity of the disability insurance program, support working Americans with disabilities, and protect benefits for current and future generations.

“In addressing this looming crisis, we cannot afford to kick the can down the road by taking money from retirees and ignoring the program’s real problems,” Dr. Coburn said.

“Despite skyrocketing expenditures, we have failed to provide disabled Americans with the resources they need and want so they can work to the best of their abilities. We have failed to reform program rules that are too often abused and gamed. And we have failed to reverse the growing treatment of the program as an early retirement and unemployment system. We can do better.”

“I hope this bill will begin a serious conversation about how best to address the fundamental challenges faced by the disability program. Ignoring these problems does nothing but threaten the benefits upon which millions of disabled Americans depend.”

The Protecting Social Security Disability Act strengthens the program to preserve it for current and future generations, strengthens and improves the application process to ensure benefits are adequate and quickly available for only those who need them, and provides resources and incentives to disabled Americans who want to work and have the ability to do so. It does this by, among other things:

- Updating the program’s disability classifications to ensure those with temporary disabilities are admitted to the program on a temporary basis;

- Mandating the use of medical continuing disability reviews (CDRs) for those admitted on a permanent basis but whose improvement is possible;

- Reforming the disability hearing process to require the submission of all relevant evidence on a timely basis and implementing additional procedural rules that will make hearings more fair, consistent, and efficient;

- Eliminating the 'substantial gainful activity' earnings limit for beneficiaries and providing incentives to maximize their earnings;

- Exploring innovative ways to direct resources toward high-risk individuals to help them stay in their jobs, such as identifying disability applicants not yet in the program and provide them with training, benefits or stipends.

A statement for the record accompanying the bill can be found here.

A section-by-section summary can be found here.

###

Dec 16 2014

Senators Baldwin and Coburn Applaud Commitment to Enhance Access to HIV Drugs in Developing Countries

Washington, D.C. – U.S. Senators Tammy Baldwin (D-WI) and Tom Coburn (R-OK) sent a letter applauding AbbVie Inc.’s recent agreement with the Medicines Patent Pool (MPP) to enhance affordable access to HIV treatments for children in developing countries. The Senators expressed support for negotiations earlier this year and are now commending the licensing agreement for two World Health Organization-recommended medicines for children that will allow the drugs to be made at a lower cost for pediatric HIV patients in the developing world.

“I am extremely encouraged by this commitment to help provide affordable and essential HIV treatments to children in developing countries,” said Senator Baldwin. “Combatting HIV/AIDS requires collaboration from everyone, and AbbVie’s partnership with the Medicine’s Patent Pool marks another important step in our country’s fight to help the most vulnerable and to achieve an AIDS-free generation.”

“I applaud AbbVie for working to extend the reach of its lifesaving drugs to children in need around the world,” Dr. Coburn said. “Its decision brings us one step closer to achieving an AIDS-free generation.”

The Medicines Patent Pool is a United Nations-backed organization founded in 2010 by UNITAID to increase access to HIV treatment and spur innovation worldwide by negotiating patent licenses for the production of low-cost versions of new and existing medicines. The AbbVie-MPP collaboration, which marks the first time AbbVie has granted a license for generic production of its HIV drugs, extends MPP’s portfolio to eleven antiretrovirals and for one medicine for an HIV opportunistic infection. Ten generic manufacturers have now licensed from the organization.

An online version of the letter can be found here.

An online version of this release can be found here.

###

Senator Tom Coburn today objected to passage of a bill supporters claim would help prevent veterans’ suicides but would actually do little to actually fix the broken VA health system that is failing to adequately care for veterans.

“Instead of holding VA bureaucrats accountable to ensure existing efforts are meeting the mental health needs of veterans, this bill would duplicate programs the VA which the agency has already failed to manage,” Coburn said.

“All Americans-- veterans and taxpayers alike-- should be outraged at this tragic situation. Those calling my office in support of this bill should instead be calling the VA demanding the agency and their own member of Congress demanding that they keep the promise to care for veterans.”

While well-intentioned, H.R. 5059 would do little to change or improve the deplorable situation at the VA, which is providing substandard medical care for the country’s military heroes. The bill creates several new programs at the VA and authorizes $22 million in new federal spending. In almost every case, however, the VA already has the tools and authorities it needs to address these serious problems. Further concerns with the legislation can be viewed here.

“Congress should hold VA bureaucrats accountable for their failing programs and substandard medical care instead of passing legislation that will do little to solve the tragic challenge of veteran suicides.” said Senator Coburn. “Our military heroes deserve more than false promises. It is dishonest for Congress to pretend that passing yet another bill will finally solve the challenges plaguing the VA.”

“The VA has proven that questions need to be asked before it is entrusted with the lives of veterans or the money of taxpayers. The only way Congress can help the VA solve this problem is through rigorous oversight, to ensure the promises we’ve already made are being carried out. New programs and new funding is not the answer, but give false hope to those already suffering.”

More than 1,000 veterans have died a result of poor medical care and waiting lines at the VA, found Friendly Fire: Death, Delay, and Dismay at the VA, a report on mismanagement at the VA released by Dr. Coburn earlier this year. Among its findings, the report exposed the failure of the VA in addressing the mental health needs of our servicemen and women. The VA failed to meet its 14-day goal in 34 percent of new mental health appointments in the areas of psychiatry, psychology, post-traumatic stress disorder, and substance abuse in 2013.

“This is a serious issue and needs a serious response. Only in Washington would someone think the answer is to give more money and responsibility to an agency that has made headlines all year for providing substandard care, long delays for veterans to see a health care provider, and mismanagement,” said Coburn. “Instead of pretending this bill will somehow fix the problem—which the President just signed a $10 billion bill in August to address—is typical Washington.”

As a physician, Dr. Coburn believes veterans should have access to the best medical are and any doctor they choose, not locked inside this broken system that clearly does not have the necessary mix of providers needed to care for vets in a timely manner. The legislation he introduced with Senators McCain and Burr, the Veteran’s Choice Act, was the basis for giving veterans more choice and accessibility to medical providers and non-VA hospitals in veteran’s hometowns.

“How many bills need to be passed before Congress realizes the VA is unaccountable and takes real actions to ensure the fulfillment of the promises made to our veterans?”

A video of the speech is here.

Senator Coburn will offer a motion today in an attempt to undo a precedent set in 2011 that took away the right—provided by Senate rules—for senators to suspend the rules post-cloture to offer an amendment. This right allowed the minority or individual senators to circumvent parliamentary obstacles, namely filling the tree, to receive votes.

The question essentially will be do you want to keep the Reid Motion to Suspend precedent prohibiting Motions to Suspend the Rules post-cloture by sustaining the precedent.

Voting Yes keeps the Reid precedent

Voting No reverses the Reid precedent

If the precedent is overturned by a majority of senators voting against the ruling of the chair, the rights of senators—as written in senate rules to suspend the rules post-cloture —would be returned.

If Dr. Coburn is successful overturning the Reid precedent, he is NOT planning to follow up with another motion to allow the offering an amendment. This will be a purely procedural vote seeking to restore a right written in Senate Rules.

This document provides an overview of the history leading up to this precedent and outlines the motion Senator Coburn will offer to attempt to reverse it and restore the right provided by Senate rules.

Majority Leader Blocking Amendments by “Filling the Tree”

- The distinguishing characteristics of the Senate are the right to offer amendments, and the right to debate.

- Throughout his tenure, Senate Majority Leader Harry Reid has aggressively deployed a tactic to block other senators from offering amendments to legislation. This tactic, known as “filling the tree,” fills all available slots for amendments with shell legislation, preventing all other senators from offering amendments.

- Senator Reid has deployed the “filling the tree” maneuver over 90 times during his tenure as Majority Leader. To put this number in perspective, Senator Reid has filled the amendment tree more than all the other Majority Leaders combined between 1985 and 2006 (40 times).

- This tactic effectively shuts out every individual member of the Senate from offering input on legislation.

Senators Resort to Motions to Suspend the Rules Offer Amendments

- Starting in 2010, as Senator Reid continued to use the “filling the tree” maneuver, senators in both parties resorted to other procedural options to assert their rights as senators.

- Under Rule V of the Standing Rules of the Senate, the other rules may be suspended, including blocking amendments by “filling the tree.”

- From 2010 until October 6, 2011, senators filed more than 30 notices and the Senate held more than 15 votes to suspend the rules to allow amendments to be offered during post-cloture debate.

Reid Precedent Breaks the Rules to Eliminate Senators’ Right to Suspend the Rules

- On October 6, 2011, the Senate Majority Leader changed Senate rules with a simple majority rather than the required two-thirds vote, ending the right of senators to suspend the rules post-cloture.

- Senator Reid called up a motion to suspend the rules that had been filed the previous day by Senator Coburn. Senator Reid made a point of order that this single motion to suspend was dilatory under Rule XXII.

- The presiding officer correctly ruled the post-cloture amendment was not dilatory under Rule XXII. A single motion to suspend the rules cannot be considered a delaying tactic. Senator Reid’s point of order was not sustained.

- Senator Reid than appealed the ruling of the chair, and held a vote to overturn it. By a simple majority vote (51 to 48), the chair’s decision was overturned. Every Republican and one Democrat voted against this appeal, instead voting to uphold the presiding officer’s decision which reflected the written rules of the Senate.

- This vote established a new precedent making it out of order to offer post-cloture motions to suspend the rules despite such right being explicitly provided under Senate rules.

- Two years later on November 21, 2013, the majority further weakened the Senate when 52 Democrat senators voted to override Senate rules that require the president’s nominees to be approved by three-fifths of the Senate before confirmation, reinforcing the dangerous trend started in 2011. The vote to nullify the 2011 decision will not reverse this precedent.

Reversing the October 6, 2011 Reid Precedent

- In order to overturn this precedent, a senator must offer another post-cloture motion to suspend the rules for the purpose of considering an amendment.

- The presiding officer will likely rule that the motion is not in order based on the 2011 precedent.

- At that point, the senator offering the motion will appeal the ruling of the chair, on the basis that a single motion to suspend the rules post-cloture is not dilatory. The senator would then ask for the yeas and nays.

- If a simple majority of senators vote to overturn the decision of the chair, the precedent will be reversed, restoring the right explicitly provided in the rules that allows senators to offer motions to suspend the rules post-cloture as before.

The roll call and Congressional Record from October 6, 2011 is here.

Prevention of veteran suicides should be among the foremost of VA’s goals, and Congress should be performing aggressive oversight to ensure existing programs and authorities are striving to this end.

H.R. 5059 creates a number of new programs at the VA and $22 million in new federal spending. In almost every case, VA already has the tools and authorities it needs to address these problems. The department needs leadership, not another piece of ineffective legislation. Congress should be holding the VA accountable rather than adding to its list of poorly managed programs. The VA has proven that questions need to be asked before it is entrusted with the lives of veterans or the money of taxpayers.

Rajiv Jain, the Veterans Health Administration's assistant deputy undersecretary for health for patient care services, told members of the House Veterans' Affairs Committee last month that while the department supported the goals of the bill, the legislation overlaps with existing programs.

Further concerns with the legislation can be viewed here.

“To know how to reach a destination, you must first know where you are. Without oversight -- effective, vigorous oversight -- you'll never solve anything. You cannot write a bill to fix an agency unless you have an understanding of the problem. And you can only know this by conducting oversight, asking the tough questions, holding the bureaucrats accountable, find out what works and what doesn't and know what has already been done. Effective oversight is an effective tool to expose government overreach and wasteful spending, but it also markedly exposes where we lose our liberty and our essential freedoms. True debates about national priorities would come about if we did effective oversight. It is the senate, once hailed as the world's greatest deliberative body, where these differences should be argued. Our differences should be resolved through civil discourse so they're not settled in the street. Just as the constitution provides for majority rule in our democracy while protecting the rights of the individual, the senate must return to the principles to gain the trust of the electorate. And it can.” – Dr. Coburn

Watch his full speech here.

Read the transcript here.

Dec 09 2014

Coburn Releases Report Decoding the Tax Code

As Washington politicians rush to pass another end of the year bill extending billions of dollars in tax breaks for special interests, a new report highlights over $900 billion of giveaways throughout the tax code.

More than 165 tax expenditures worth over $900 billion this year and more than $5 trillion over the next five years are revealed in Tax Decoder, a new report decoding the tax code.

Gamblers who lose at the casino or horse track can still win on their tax return by writing off gambling losses. Hollywood movie makers aren’t just collecting at the box office, they are also downloading tax subsidies from the IRS. There is no shortage of tax subsidies for the rich and famous, such as credits to renovate vacation homes and purchase luxury cars and deductions for yachts.

Ideally, Congress would throw out the entire tax code and start over, but at the very least the code should be made simpler, fairer and flatter. This report provides a list of options for Congress to streamline and simplify the tax code to achieve that goal. While many of the tax breaks identified throughout this report should be phased out or eliminated, others could also be reformed to better achieve their intended purpose.

Read the full report here.

Read the introduction here.

Read the highlights here.

The Tax Decoder highlights reel features Lady Gaga, Starbucks, IHOP and other tax subsidies for the rich and famous. Watch it here.

Examples of just a few of the tax preferences highlighted in Tax Decoder include:

- Billions of dollars in tax breaks go to wealthy pro sports team owners, who can count the roster of players as a depreciable asset.

- The Tuna Tax Break provides nearly $10 million to certain domestic corporations operating in American Samoa.

- Tax credits for historic and nonhistoric structures result in lost revenue of $1 billion annually, subsidize beach front resorts, Major League Baseball stadiums, and luxury hotels.

- Ani DiFranco, a Grammy award winning artist, took advantage of $1.5 million in historic preservation tax credits and $3.7 million in New Market Tax Credits to build her Righteous Babe record label headquarters.

- Many charities give little to their cause, despite paying no taxes. For example, Lady Gaga’s 501(c)(3), the Born This Way Foundation, raised $2.6 million in 2012, but only gave away $5,000 for “grants to organizations or individuals.”

- For FY 2014, the tax gap will likely be about $500 billion. If this amount were fully paid, virtually the entire deficit currently projected for FY 2014, $483 billion, could be eliminated.

Dr. Coburn sent a letter opposing the inclusion of a public lands package in the unrelated National Defense Authorization Act. This would be the largest park expansion in a single measure by Congress since 1978, despite an unsustainable $12 billion deferred maintenance backlog in our existing National Park System. Read the letter here.

Dr. Coburn released a report documenting how Congress has used the National Park Service to advance parochial interests while failing to keep our existing commitments to America’s national treasures. Read the full report here.

(WASHINGTON, D.C.) –Due to a lack of transparency, some health providers may be charging double, triple, or more what another provider down the road charges for the same procedure—resulting in higher out of pocket costs for patients— according to a new report by the Government Accountability Office (GAO) requested by Sens. Coburn, Klobuchar, Shaheen, and Toomey. The GAO also found significant weaknesses in the Centers for Medicare and Medicaid Services (CMS)’ price and quality transparency tools for consumers. As a result, it can be nearly impossible for patients to obtain information on the cost and quality of health care prior to a procedure, causing some patients to spend more on health care without receiving better care.

U.S. Senator Tom Coburn, M.D. (R-Okla.) released the following statement:

“Transparency in the cost and quality of health care is crucial in creating a competitive market to improve health outcomes while driving down costs for patients. The innovative Surgery Center of Oklahoma, for example, posts the prices of procedures on their website so that consumers can make informed decisions on their health care. Patients come to the surgery center from all over the country and Canada because of the high quality care they provide at a lower cost. Unfortunately, the GAO report reveals that CMS is failing to provide similar transparency on the cost and quality of health care. Congress should call on CMS to improve their transparency tools, allowing consumers to compare providers based on out-of-pocket costs, patient-reported outcomes, and the combination of cost and quality information.”

You can read the entire report here.

WASHINGTON – House Oversight and Government Reform Committee Chairman Darrell Issa (R-CA), Sen. Tom Coburn (R-OK), and Rep. Phil Gingrey (R-GA) today released a report they requested from the U.S. Government Accountability Office (GAO) examining the use of “official time” for union business at government agencies. Official time is when a federal worker stops performing the job for which they were hired and instead engages in union activity, at taxpayer expense. The report, titled, “Labor Relations Activities: Actions Needed to Improve Tracking and Reporting of the Use and Cost of Official Time,” includes The Office of Personnel Management’s (OPM) admission that official time reporting is not a priority, raises questions about OPM’s methodology for collecting data on official time, and shows the amount of official time could be as much as $5 million higher for the agencies studied. While OPM estimated that the federal government spent more than $156 million during fiscal year 2012 on official time, GAO estimated the cost of official time to be 15 percent higher than OPM estimates at 4 agencies.

“This study shows that the federal government is falling short in keeping track of so-called ‘official time’ and must make changes to prevent underreporting,” said Chairman Issa. “Taxpayers have the right to know the true cost of the union activity they are funding.”

Sen. Coburn said, “With veterans literally dying waiting to see a doctor, VA staff should be focused on fulfilling the promises made to America’s heroes rather than on performing union duties to secure greater benefits for themselves.”

“GAO’s report confirms that more work needs to be done to ensure transparency and accountability when reporting official time,” said Rep. Gingrey. “As long as taxpayers are forced to subsidize union activity, they should—at the minimum—have access to reliable data that shows where their hard-earned money is being spent. It is past time for the federal government to make American families—not Big Labor—its priority.”

You can read the entire report here.

###

(WASHINGTON, D.C.) – U.S. Senator Tom Coburn, M.D. (R-Okla.), Ranking Member of the Homeland Security and Government Affairs Committee, released the following statement regarding the White House cyber intrusions reported Tuesday:

“I’m deeply concerned about the reported attacks on White House networks.

“We’ve worked very closely with the administration to improve our nation’s cybersecurity. This year, Chairman Tom Carper and I came together to craft legislation, the Federal Information Security Modernization Act (S. 2521) to help secure federal networks from these sorts of attacks. We included the White House in our negotiations, to make sure we got it right.

“So I’m disappointed that the White House decided not to notify Congress of the breach, even as its officials debated with my staff the need for agencies to tell Congress when they’ve been hacked.

“I have pressed the administration to share details about what has happened and how the attack succeeded. I have yet to receive satisfactory answers. Let us seize this opportunity to work together to protect against this very serious threat to our national security and economy.”

###

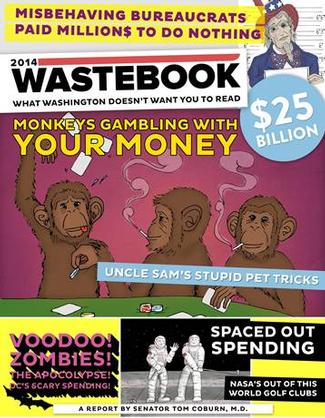

Voodoo Dolls, Gambling Monkeys, Zombies in Love and Paid Vacations for Misbehaving Bureaucrats Top List of the Most Outlandish Government Spending in Wastebook 2014

Gambling monkeys, dancing zombies and mountain lions on treadmills are just a few projects exposed in Wastebook 2014 – highlighting $25 billion in Washington’s worst spending of the year.

Wastebook 2014 — the report Washington doesn’t want you to read —reveals the 100 most outlandish government expenditures this year, costing taxpayers billions of dollars.

“With no one watching over the vast bureaucracy, the problem is not just what Washington isn’t doing, but what it is doing.” Dr. Coburn said. “Only someone with too much of someone else’s money and not enough accountability for how it was being spent could come up some of these projects.”

“I have learned from these experiences that Washington will never change itself. But even if the politicians won’t stop stupid spending, taxpayers always have the last word.”

Congress actually forced federal agencies to waste billions of dollars for purely parochial, political purposes.

For example, lawmakers attached a rider to a larger bill requiring NASA to build a $350 million launch pad tower, which was mothballed as soon as it was completed because the rockets it was designed to test were scrapped years ago. Similarly, when USDA attempted to close an unneeded sheep research station costing nearly $2 million every year to operate, politicians in the region stepped in to keep it open.

Examples of wasteful spending highlighted in “Wastebook 2014” include:

- Coast guard party patrols – $100,000

- Watching grass grow – $10,000

- State department tweets @ terrorists – $3 million

- Swedish massages for rabbits – $387,000

- Paid vacations for bureaucrats gone wild – $20 million

- Mountain lions on a treadmill – $856,000

- Synchronized swimming for sea monkeys – $50,000

- Pentagon to destroy $16 billion in unused ammunition -- $1 billion

- Scientists hope monkey gambling unlocks secrets of free will –$171,000

- Rich and famous rent out their luxury pads tax free – $10 million

- Studying “hangry” spouses stabbing voodoo dolls – $331,000

- Promoting U.S. culture around the globe with nose flutists – $90 million

Read the full report here.

Watch the Wastebook 2014 videos here and here and here.

###

Oct 01 2014

New Report Details Millions Spent on Unnecessary Transport of Surplus Vehicles From Afghanistan

WASHINGTON –According to a recent report by the Government Accountability Office (GAO), the Department of Defense (DOD) spent tens of millions of dollars in unnecessary returns of surplus vehicles from Afghanistan to the United States during a one year period. Today, a bipartisan group of Senators on the Committee on Homeland Security and Governmental Affairs highlighted the report findings.

The report, Afghanistan Equipment Drawdown: Progress Made, but Improved Controls in Decision Making Could Reduce Risk of Unnecessary Expenditures (GAO-14-768), found that during a one-year period, the United States Army and Marine Corps returned more than 1,000 military surplus vehicles from Afghanistan to the United States, even though the vehicles were not determined to be needed and therefore should not have been returned. The cost of returning a vehicle to the U.S. is upwards of $100,000 per vehicle - for a total cost as high as $100 million in unnecessary shipments during the period of time examined by GAO. The vehicles in question were no longer needed by the military. The report found that if the Army and Marine Corp had followed Department of Defense proper rules and procedures, the services would have either transferred the surplus vehicles to appropriate overseas allies or scrapped the vehicles in Afghanistan, saving a significant amount of money in logistical and shipping costs.

Senator Carper, Chairman of the Committee on Homeland Security and Governmental Affairs:“This report is a troubling reminder that the Department of Defense has more work do in managing taxpayer dollars. The Government Accountability Office underscores that the DOD can and should do a much better job in preventing unnecessary costs by taking some common sense steps in managing its surplus military vehicles. We simply cannot afford this type of waste and ineffectiveness. Given the tremendous fiscal challenges our government faces, we have an obligation to look in every nook and cranny of our budgets for savings. I believe this is an area where simple yet effective improvements can be made to achieve better results for less money.”

Dr. Coburn, Ranking Member of the Committee on Homeland Security and Governmental Affairs:“Until DOD leadership gets serious about financial management and fundamentally changes the way the Department manages its business and holds itself accountable, Americans will continue to see DOD waste scarce taxpayer dollars. Despite the Department’s assurances that it is making progress and working hard to be better stewards of taxpayer dollars, we see examples like this time and again. Especially in this budgetary environment, actions matter more than empty promises.”

Senator McCaskill, Chairman of the Subcommittee on Financial and Contracting Oversight: “At a time when we’re turning over every rock to find savings for taxpayers—and while we’re engaged in a national conversation about the use of military equipment at home—this kind of waste is unacceptable. I expect military leaders to take these findings seriously and do better.”

Senator Tester, Chairman of the Subcommittee on Efficiency and Effectiveness of Federal Programs and the Federal Workforce: “This issue deserves the highest level of attention and oversight,” Tester said. “While I understand the Defense Department is operating under intense time and budget pressures, we must use common-sense when it comes to spending taxpayer dollars – especially when Americans have already paid a steep price for this conflict.”

(WASHINGTON, D.C.) – The federal government underreports cost savings from federal data center consolidation by billions of dollars, according to a new report by the Governmental Accountability Office (GAO).

The Federal Data Center Consolidation Initiative (FDCCI) is a government-wide effort to reduce the number of redundant data centers, which have grown from several hundred in the late 1990s to nearly 10,000 today.

According to the GAO report, agencies have struggled to accurately calculate the amount of savings they have and will achieve through data center consolidation. Further, GAO found that agencies are underreporting their FDCCI savings to the Office of Management and Budget (OMB), forcing OMB to underreport the total savings to Congress.

The report found that consolidation would lead to savings of $3.1 billion through next year. However, the amount agencies have reported to OMB for the same time period is $876 million, meaning total savings have been underreported to OMB by approximately $2.2 billion. The Department of Defense (DOD) has also significantly scaled back its earlier planned savings estimates, from $4.7 billion through FY 2017 to $2.6 billion.

GAO estimates that consolidating federal data centers could save over $5 billion through Fiscal Year (FY) 2017 and over $10 billion in later years. However, until agencies improve their reporting practices and OMB assists agencies in calculating savings, agencies will continue to have difficulty measuring progress toward cost-savings goals, the report found.

“Vast amounts of taxpayer savings can be achieved by consolidating the thousands of redundant data centers operated by the federal government. While progress has been made, this report makes clear that more can be done to achieve significant savings,” Dr. Coburn said. “It is also important to get the numbers right. Improving transparency will better allow agencies to gauge their progress and help Congress hold them accountable. I am pleased the Senate recently passed the Federal Data Center Consolidation Act to address GAO’s recommendations.”

“The Administration’s Federal Data Center Consolidation Initiative is an ambitious challenge that is worth meeting – and today’s report from the Government Accountability Office underscores its potential,” said Senator Carper, Chairman on the Senate Committee on Homeland Security and Governmental Affairs. “This report shows that agencies are achieving significant cost savings and taking innovative steps to trim the federal government’s massive information technology portfolio – saving billions of taxpayer dollars in the process. That being said, the report also underscores the critical need for agencies to improve reporting. As the saying goes, you can’t manage what you can’t measure. Without accurate tracking and reporting of performance measures, we run the risk of not achieving the full potential savings. This means it is critical that the Office of Management and Budget and agencies continue to improve their process for reporting, tracking and measuring progress on this initiative. Along with this, I will continue to work closely with my colleagues in the Senate and House on bipartisan legislation that will address the necessary updates and upgrades to the federal government’s information technology management.”

GAO recommends that OMB assist agencies in reporting their cost savings. In addition, GAO recommended that OMB improve its standardized metrics so that agencies can better measure their progress. Last week a bipartisan bill passed the Senate that would address many of the issues GAO has raised in its series of reports, including requirements for improved reporting practices and standardized cost-savings metrics.

###

(WASHINGTON, D.C.) – A recent Washington Post article identified employee turnover and poor morale as challenges at the Department of Homeland Security that will prevent DHS from achieving its mission of securing the nation. Senator Tom Coburn (R-OK) reiterated his confidence in Homeland Security Secretary Jeh Johnson and urged patience in allowing the Secretary time to change the culture within the Department.

“Few members of Congress have raised more questions about the Department and its programs than I have,” commented Dr. Coburn, ranking member of the Senate Homeland Security and Governmental Affairs Committee. “But I have the utmost confidence in Secretary Jeh Johnson’s ability to lead and reform the Department. You cannot fix problems that have developed over many years overnight, and the Secretary deserves our patience as he works to change the culture at DHS.”

“Over the past year, we have seen positive steps at DHS, including efforts to strengthen management and coordination among the Department’s many components and offices. We have also seen Sec. Jeh Johnson take decisive actions to fix problems and curb waste within DHS, such as abusive overtime practices. Some of those decisions may be unpopular but they are the right thing to do,” Dr. Coburn continued.

One of the challenges identified in the Washington Post report was vacancies in key leadership positions within DHS. Led by the Senate Homeland Security and Governmental Affairs Committee, the Senate has confirmed 9 key DHS nominations since Sec. Johnson’s confirmation. “With very few exceptions, our committee has supported the President’s nominations for DHS with broad, bipartisan support. We are working hard to give Secretary Johnson the senior leadership team he needs. Changing the culture within a bureaucracy is always a challenge and to do it successfully requires real and committed leadership which I believe Jeh Johnson is providing. Congress needs to play its part through oversight to assist the Secretary to identify areas that need improvements and pass bills to give him the authority to make the necessary changes, such as reducing unnecessary duplication or adding measurable outcomes and performance goals.”

###(WASHINGTON, D.C.) – The Department of Homeland Security (DHS) and the General Services Administration (GSA) have not updated or revised a plan to ensure that the $4.7 billion DHS consolidation project at St. Elizabeths makes operational and fiscal sense, a new report from the Government Accountability Office (GAO) concludes. The St. Elizabeths campus is the location in Southeastern DC where DHS has planned to construct a consolidated headquarters. It currently houses the U.S. Coast Guard.

Identifying the challenge of funding realities and changing workplace standards, the GAO report raises questions about the long-term viability of the project. Pending the development of reliable cost and schedule estimates, the project risks further potential cost overruns, missed deadlines, and performance shortfalls.

“Taxpayers have invested more than $1.5 billion in the DHS headquarters consolidation project at St. Elizabeths. It is disappointing that we don’t yet have a detailed and viable plan for the consolidation. DHS needs to present us with a realistic plan for consolidating its operations while also saving tax dollars by closing some of its leased facilities across the region,” said Dr. Tom Coburn, ranking member of the Senate Homeland Security and Governmental Affairs Committee.

The report raises questions about the long-term viability of the project, and GAO recommends that Congress consider making future funding for the project contingent upon DHS and GSA developing a clear plan and schedule for its completion.

“I strongly support GAO’s recommendations,” commented Dr. Coburn. “Any new funding for the headquarters consolidation should be halted until DHS develops a revised plan for the further development and occupation of the campus.

###

Sep 22 2014

Bipartisan Bill to Consolidate Federal IT Infrastructure, Save Up to $3 Billion Passes Senate

Washington, DC – The U.S. Senate last week passed a bipartisan bill to expedite the consolidation of federal data centers that could save up to $3 billion in taxpayer dollars. The bill sets hard deadlines and requires federal agencies that have yet to act on consolidation initiatives to conduct inventories and implement consolidation strategies. In addition, the law would require the Government Accountability Office (GAO) to verify agency data center inventories, and would direct the Office of Management and Budget (OMB) to routinely report to Congress on cost savings realized to date.

The Federal Data Center Consolidation Act was introduced by U.S. Senators Michael Bennet (D-CO), Tom Coburn (R-OK), and Kelly Ayotte (R-NH) in October 2013. Senate Homeland Security and Government Affairs Chairman Tom Carper (D-DE) joined the effort and helped usher the bill through the committee last November.

“This bill represents a smarter, more efficient way to operate government and save taxpayer dollars. It will also reduce the federal government’s energy consumption across the country,” Bennet said. “OMB set ambitious but achievable goals that federal agencies are not on track to meet. We’re proposing to hold them accountable in these efforts.”

“The Federal Data Center Consolidation Act builds upon OMB’s efforts to reduce duplication in federal data centers. GAO has described this legislation as ‘essential’ to ensuring agencies make adequate progress in consolidating their data center inventories and saving taxpayers money,” Dr. Coburn said. “The bill is a crucial component in our efforts to reform the way the federal government acquires and manages IT.”

“The Administration’s Federal Data Center Consolidation Initiative is an ambitious challenge that is worth meeting. While evidence shows a major shift in the way the federal government thinks about and pursues IT management in its operations, it’s clear that some agencies have more work to do,” Chairman Carper said. “We need to salute the success stories and push those agencies that have fallen short to work harder. This measure is part of a larger effort to improve our federal government’s IT management and will help agencies focus their efforts on consolidation, better manage their inventories, and ensure that the Administration’s Consolidation Initiative is seen through to its conclusion. I want to thank Senators Coburn, Bennet, and Ayotte for their work on this important issue.”

“With over $17 trillion in debt, there’s no excuse to continue to spend millions on wasteful and unnecessary federal data centers – some of which are utilizing only a fraction of their capacity,” said Ayotte. “I’m pleased that the Senate passed our bipartisan bill, which will save taxpayer dollars by speeding up consolidation and increasing the efficiency of data centers across government.”

A number of studies have shown a relatively low utilization rate of the current IT infrastructure, resulting in an enormous amount of wasted space and energy – and unnecessary costs. In 2010, the Office of Management and Budget (OMB) instructed federal agencies to develop consolidation plans under the administration’s Federal Data Center Consolidation Initiative (FDCCI), which could save up to $3 billion by 2015, according to the GAO, with additional savings beyond that date. However, the GAO also found that a number of agencies have been slow to implement these plans – or, in some cases, to even inventory the total number of data centers they currently manage.

The GAO has publicly endorsed the legislation, saying it is vital to ensure that agencies close down unnecessary data centers by the target deadline. The senators have worked closely with OMB and GAO to ensure that this bill will help strengthen the initiative and achieve meaningful savings.

The bill is also supported by the Professional Services Council and the Information Technology Industry Council.

The lawmakers previously filed the bill as an amendment to the Energy Savings and Industrial Competitiveness Act of 2013 and to the FY 2014 National Defense Authorization Act.

###

Sep 19 2014

Senate Approves Carper, Coburn Legislation to Curb Improper Payments to Deceased Individuals

Last night, the Senate approved legislation to curb millions of dollars in improper payments to deceased individuals. The Improper Payments Agency Cooperation Enhancements Act (IPACE), introduced by Homeland Security and Governmental Affairs Committee Chairman Tom Carper (D-Del.) and Ranking Member Tom Coburn (R-Okla.) is bipartisan legislation that builds upon Chairman Carper’s existing improper payment laws, enacted in 2010 and 2012.

“All too often, we hear stories of criminals taking advantage of basic errors in the way our government maintains and shares death records,” said Chairman Carper. “Not only do these types of errors waste millions of taxpayer dollars annually, but they also undermine confidence in our government. That’s frankly unacceptable. This bill fixes this problem by implementing some basic reforms. It ensures that federal agencies keep track of people who have died, shares that information, and ultimately prevents payments to people who are obviously no longer eligible for federal benefits and payments. By taking some long overdue and common sense steps like providing federal agencies with access to the most complete and accurate list of people who have died, we can put an end to this unacceptable practice once and for all. I thank my Senate colleagues for supporting this legislation and urge my House colleagues to support its passage.”

“It is inexcusable that in the 21st century, one federal agency doles out money to individuals that another federal agency knows to be deceased,” said Dr. Coburn. “Errors like this cost taxpayers millions of dollars and this bill will bring much needed transparency to ensure that deceased individuals are no longer receiving federal benefits.”

This legislation comes after a Homeland Security and Governmental Affairs Committee in May 2013 that examined initiatives by the Executive Branch to reduce the improper payments made by federal agencies. The hearing examined improper payments to deceased individuals, often due to inadequate sharing among federal agencies of basic death data maintained by the Social Security Administration (SSA). Most federal agencies rely on a slimmed down, incomplete, and less timely version of the death data that is also available to some private sector and public entities. IPACE will correct these problems by making the following changes:

- Allow Federal Agencies Access to the Complete Death Database. Under current law, only some agencies may have access to the complete death data. IPACE allows all appropriate federal agencies to have access to the complete death data for program integrity purposes, as well as other needs such as public safety and health. The substitute includes a “sunset” of this provision after five years.

- Require Use of Death Data to Curb Improper Payments. IPACE would require that federal agencies make appropriate use of the death data in order to curb improper payments.

- Improve the Death Data. The legislation establishes procedures to better facilitate the sharing of death data among federal agencies, such as death information from the Department of Defense, which records some deaths overseas.

###

(WASHINGTON, D.C.) – Today, U.S. Senators Tom Coburn (R-OK) and Mazie Hirono (D-HI) introduced S.2852, the State Regulatory Representation Clarification Act of 2014 which would clarify Congressional intent that the Board of the Federal Deposit Insurance Corporation (FDIC) should include at least one individual who has worked as a state bank regulator.

“Washington does not always know best, and it is important that Congress reaffirms and clarifies its intent that the FDIC will benefit from the view of those with firsthand experience regulating the banking industry at the state level,” Dr. Coburn said. “Our financial regulatory framework needs multiple perspectives, and the state bank regulatory perspective is a critical ingredient in that mix.”

“Hawaii families and businesses face unique circumstances and rely on local banks and credit unions that understand those circumstances to help them buy new homes or get a loan to start a new business,” said Hirono. "In fact, seven of the twelve banks in Hawaii are state chartered, accounting for 84 percent of the small business loans made in the state. It is important that people who understand the perspective of community banks and how they serve different communities are represented on the FDIC board.”

We know the consequences of an assumption that all good ideas come from Washington. State banking regulators bring an essential point of view to local credit markets and the role of banks in communities throughout the country.

###

Sep 17 2014

Dr. Coburn’s Concerns with S. 1086, the Reauthorization of the Child Care Development Block Grant Program

Enumerated Powers:

As a family physician, Dr. Coburn understands the importance of quality child care and early education, and the need to ensure that children are cared for in a secure environment where they can grow and learn. However, it is not the proper role of the federal government to oversee child care or education. The U.S. Constitution does not give the federal government any authority or role in these matters.

Increased Funding:

The new mandates in this bill would cost an additional $1.2 billion in order to continue serving the same number of families. The added expense to taxpayers is not offset through reductions in spending elsewhere.

Duplication:

In a February 2012 report, the Government Accountability Office (GAO) found the federal government is currently administering 45 programs to provide or support child care and related services to children from birth through age five, as well as several tax credits to subsidize private expenditures for early learning and child care. The programs operate under numerous departments including the Departments of Agriculture, Interior, Justice, Labor, Housing and Urban Development, the General Services Administration, and the Appalachian Regional Commission. The Temporary Assistance for Needy Families (TANF) block grants given to states also provide funding for child care programs.

Misguided Mandates:

The bill restricts a state’s frequency of income checks to once every year rather than every six months. States should not be restricted from trying to keep their programs restricted to those truly in need by performing income checks more than once a year. States have created solutions to ensure families are not adversely affected by these checks (such as sudden drop-offs from the program), and they can remain accountable for the success of their programs.

The bill places new requirements on states for their health, safety, and fire inspections of all child-care providers before licensing and annually thereafter. Most states already conduct these inspections. This provision will require an additional $35 million per year to implement, according to the Congressional Budget Office.

Sep 09 2014

Reducing Insurance Subsidies for Wealthy Farmers Could Save Hundreds of Millions Annually

(WASHINGTON, D.C.) – Reducing Crop Insurance subsidies for America’s wealthy farmers could save hundreds of millions annually for taxpayers, according to a new report from the Government Accountability Office (GAO). GAO’s report examined the effects of reducing the federal subsidy for crop insurance revenue policies, and found possible savings of nearly $2 billion per year with little effect on farmers’ total production cost per acre.

“This report provides us a blueprint on how to save hundreds of millions of dollars with little impact on our farm industry.” Dr. Coburn said. “The Federal Government needs to get out of the business of subsidizing the wealthiest farmers.”

GAO’s report notes that the cost to the federal government of the crop insurance program increased from an average of $3.4 billion per year from 2003 through 2007 to an average of $8.4 billion per year from 2008 through 2012, peaking at $14.1 billion in 2012, a new record. During this time period, the rate of premium subsidies provided by the federal government increased from 37 percent to 63 percent and the amount of acreage covered by the program increased dramatically, all while the farm industry was bringing in record profits.

The GAO report also found median farm household income was significantly higher than median income for all U.S. households in 2012. While the median income for all U.S. households was $51,017, households associated with farms specializing in cash grains such as corn or soybeans had a median household income of about $82,300 and farms specializing in a few choice crops (rice, tobacco, cotton, and peanuts) netted a median income of $101,400. Success does not need a government subsidy.

###

Prompted by the surprisingly militarized police response to protests and civil unrest in Ferguson, Missouri, last month, the Senate Homeland Security Committee is holding a hearing to examine the federal programs which have helped state and local law enforcement equip themselves with paramilitary weaponry, equipment and vehicles. Additional information is here.

Aug 28 2014

Oklahoma Delegation Responds to Obama Administration’s Failure to Grant ESEA Extension

WASHINGTON, D.C. — Today the Oklahoma delegation criticized the Obama Administration for failing to approve a one-year extension of Oklahoma’s Elementary and Secondary Education (ESEA) Flexibility:

"The Obama Administration doesn't like when Oklahomans buck big government regulations, and today the Administration responded by penalizing our children with failing to grant the one-year extension of the ESEA flexibility," said Sen. Jim Inhofe."Oklahomans want education reform that sets standards created and certified by Oklahoma's institutions, community leaders, and parents. Instead of supporting these values, the Obama Administration has chosen to make it more expensive and difficult to achieve the state's education goals that, once met, will exceed the requirements set by the U.S. Department of Education. As seen with ObamaCare taxes or the Endangered Species Act rulings, today's decision continues the trend of this Administration punishing Oklahoma for making decisions that represent the goals and interests of its constituents."

“Greater state and local control over education funding is vital to the success of Oklahoma's students,” said Sen. Tom Coburn. “The experiment in federal micro-management of our nation's schools has proven to be a failure. This is what makes the Secretary's decision to revoke Oklahoma's ESEA flexibility so disappointing. As Oklahoma takes concrete steps to ensure our students are prepared for their future careers, the Department should give our schools the flexibility they need to succeed.”

“The revocation of Oklahoma’s NCLB waiver—just as students begin a new school year—demonstrates this Administration’s unwillingness to allow states the time to establish state-specific, high academic standards,” said Rep. James Lankford. “The Administration granted an education funding waiver if Oklahoma would accept Common Core or if our state would establish college-ready standards. In May, our state chose to reject the Common Core standards and began writing our own. Because of that decision, the Administration has chosen to revoke what little flexibility and clarity Oklahoma educators were allowed by the federal government to help our students and teachers succeed amid a one-size-fits-all federal approach to education policy. The actions of the Administration today increase bureaucracy and decrease time to focus on academic standards.

“This is a glaring example of why the federal government should not dictate local education policy. In July of last year, the U.S. House passed an Elementary and Secondary Education Act (ESEA) reauthorization to protect local schools from new federal red tape and to provide school districts the flexibility to identify, recruit and retain the best teachers possible. Centralized, federally mandated curricula, inside-the-Beltway education funding priorities and impossible federal standards are not the answers to improve education in our nation.”

“Our state stood firm against further federal intrusion into the education of our children by rejecting the Common Core curriculum and determining that local educational leaders could best develop the appropriate curriculum for Oklahoma students,” said Rep. Jim Bridenstine. “Instead of applauding this constitutional decision and leadership, the Obama Administration decided today to reject the requested one year extension of flexibility previously granted to Oklahoma under ESEA. This politically motivated decision is the perfect example of how the unconstitutional federalization of education has effectively taken away the power reserved for the states and the people by our founders. It's time to abolish the federal Department of Education and return power to the states consistent with the 10th Amendment.”

“I'm very frustrated by this decision not just as an Oklahoma Representative but also as a parent with children in public school,” said Rep. Markwayne Mullin. “Like many Oklahoma families, my family depends on public education, and this irresponsible action promises to weaken our state's ability to provide our youth with the education they need to be successful.”

"Oklahoma's educators deserve maximum flexibility in order to provide our students with the tools to succeed,” said Rep. Frank Lucas. “Today's decision reflects just how out of touch the Obama Administration is when it comes to the needs of Oklahoma's students, and I urge the President to reconsider extending this critical education measure."

"Although the waiver was not granted, I hope that the Department of Education works with the state to ensure a smooth transition,” said Rep. Tom Cole. “Changing the standards for a school year that has already begun is untenable and will not only be rushed but will likely be difficult to implement. I am disappointed that the Administration would cause such an unfair strain on the system in Oklahoma."

On Aug. 25, the Oklahoma Delegation sent a letter to the Secretary of the U.S. Department of Education Arne Duncan requesting the agency to consider a one-year extension of Oklahoma’s Elementary and Secondary Education Act (ESEA) Flexibility. The extension would allow for Oklahoma to continue developing elementary and secondary education standards in conjunction with institutions of higher education in order to meet and exceed the U.S. Department of Education’s requirements.

The Delegation wrote, “On behalf of the State, we request that Oklahoma be afforded this one-year extension of the ESEA Flexibility in order to allow state leaders and educators the opportunity to focus on the development and implementation of Oklahoma college- and career- ready standards, as well as other State education reforms necessary to continue supporting the Principles of ESEA Flexibility.”

You can read the full text of the letter by clicking here.

###

(WASHINGTON, D.C.) – A new federal regulation would allow temporary federal employees to qualify for health coverage more quickly, but may violate current law which excludes temporary employees from receiving health benefits before one year of current continuous employment. U.S. Senator Tom Coburn, M.D. (R-OK) sent a letter to Director Archuleta, head of the Office of Personnel Management (OPM), expressing his concerns and raising questions of the legality with the proposed rule. The text of the letter is below:

August 28, 2014

Katherine Archuleta

Director

Office of Personnel Management

1900 E Street, N.W.

Washington, DC 20415-1000

Docket No.: 2014-17806

Dear Director Archuleta:

I am concerned about the July 29, 2014, proposed rule providing for health benefits for some temporary federal employees.

This rule would allow certain types of temporary, seasonal, and intermittent federal employees to qualify for health coverage under the Federal Employees Health Benefits Program (FEHBP). Eligible workers would also receive a full government contribution towards their premiums. Avoidance of the penalty under the employer mandate of the Patient Protection and Affordable Care Act appears to be a key reason the Office of Personnel Management (OPM) is moving forward with the proposal. The proposed rule discusses at length how the federal government will be subject to the mandate’s penalty if any full-time worker receives a subsidy for health insurance through an exchange.

I am concerned the proposed rule may be inconsistent with current federal law, which appears to prohibit eligibility of temporary employees for both the FEHBP and full government contribution under the conditions you established.

First, the proposed rule would allow temporary employees to qualify for the FEHBP after a 90-day waiting period, even though federal law only provides for eligibility after “1 year of current continuous employment, excluding any break in service of 5 days or less.”[1] Only under these conditions can OPM “prescribe regulations to provide for offering health benefits plans to temporary employees.”[2]

Second, the proposed rule would allow the government to make a full contribution to the premiums for such FEHBP coverage, even though federal law states, “[T]he employing agency of any such temporary employee shall not pay the Government contribution under the provisions of section 8906.”[3]

Ironically, OPM reaffirms these policies in the background of the proposal: “Currently, most employees on temporary appointments become eligible for FEHBP coverage after completing one year of current continuous employment and, once eligible for coverage, do not receive an employer contribution to premium” (page 43969).

Your department has previously acknowledged legal limitations of extending coverage under the FEHBP. Before a congressional hearing in 2010, Angela Bailey (now OPM’s Chief Operating Officer) said, “[OPM] took a very good, close look at both our regulations and the law. And the way the law is currently written, it is written in such a way that it excludes temporary employees from receiving health benefits...After 1 year, even temporary employees are eligible to apply for health benefits as long as they pay the 100 percent contribution of that” (emphasis added).[4] From my understanding, OPM has held this view for decades.[5]

I respectfully request you submit answers to the following questions about OPM’s decision to move forward with a policy that may contradict federal law:

- Does OPM agree current federal law prohibits temporary employees from qualifying for health benefits coverage before one year of continuous service? Please provide a copy of OPM’s legal analysis used to conclude this element of the proposed rule is consistent with current law.

- Does OPM agree current federal law prohibits temporary employees from receiving a government contribution toward the premiums for any such coverage? Please provide a copy of OPM’s legal analysis used to conclude this element of the proposed rule is consistent with current law.

- Has OPM’s understanding of federal law changed since it took a “very good, close look at both [OPM] regulations and the law” [6] and concluded it had no authority to expand existing health benefits available to temporary employees? If so, please describe which laws if any enacted since 2010 have given OPM authority to expand availability of such benefits.

- Please provide copies of all analyses, memoranda, and emails discussing the legality of this proposed rule.

- The proposed rule states, “Once an employee is enrolled under paragraph (j) of this section, eligibility will not be revoked, regardless of his or her actual work schedule or employer expectations in subsequent years.” Under this practice, temporary, intermittent, and seasonal employees may work significantly less than full-time and still receive coverage under the FEHBP. Please describe how OPM expects an agency to withhold an employee’s health insurance contribution if he or she did not receive a wage sufficient to cover the employee contribution in a given pay period.

- Has OPM requested any legislative changes related to health benefits coverage of temporary employees in any of the last five budget requests or through other means?

I appreciate your diligence in further evaluating the legality of the proposed rule and ask you respond to this inquiry by September 30, 2014.

Sincerely,

Tom A. Coburn, M.D.

Ranking Member

###[1] 5 U.S.C. 8906a(a)(2)

[2] 5 U.S.C. 8906a(a)(1)

[3] 5 U.S.C. 8906a(b)(2)

[4] “Temporary Employee Practices: How Long Does Temporary Last?” Hearing before the Subcommittee on Federal Workforce, Postal Service, and the District of Columbia of the Committee on Oversight and Government Reform, House of Representatives, 111th Congress, June 30, 2010, page 34.

[5] For example, see Statement of Honorable James B. King, Director, Office of Personnel Management before the Committee on Governmental Affairs, United States Senate, on Health Care Reform and the Federal Employees Health Benefits Program, May 10, 1994.

[6] “Temporary Employee Practices: How Long Does Temporary Last?” Hearing before the Subcommittee on Federal Workforce, Postal Service, and the District of Columbia of the Committee on Oversight and Government Reform, House of Representatives, 111th Congress, June 30, 2010, page 34.

WASHINGTON – Today, a bipartisan group of 12 lawmakers from the U.S. Senate and U.S. House of Representatives highlighted a new Government Accountability Office (GAO) report entitled, “Medicare Program Integrity: Increased Oversight and Guidance Could Improve Effectiveness and Efficiency of Postpayment Claims Reviews.” The report, which was undertaken following a bipartisan and bicameral request to GAO, found that the Centers for Medicare & Medicaid Services (CMS) should take additional steps to improve sufficient oversight and guidance to ensure contractor compliance with CMS regulations and to prevent claim review duplication during the auditing of Medicare providers and suppliers.

CMS utilizes four types of contractors (Medicare administrative contractors, error rate contractors, recovery auditors and anti-fraud contractors) to conduct postpayment reviews of Medicare claims in an effort to control and reduce improper payments. Each contractor has a unique role in combating improper payments. However, the lack of CMS guidance and clear requirements has resulted in duplicative work by various contractors and a lack of consistency in the communications between the contractors conducting audits and the providers/suppliers being audited.

The provider community has raised numerous concerns about the consistency and accuracy of the audit process over the past few years and this report is the first effort to determine what steps could be taken to improve the process. The information in this report can now be used by Congress and CMS to help make improvements and ensure more consistent oversight of both the contractors and audit process.

Key findings from the GAO report follow and a full copy of the report can be found HERE:

- CMS’s Current Duplication Reduction Efforts are Insufficient: CMS established the Recovery Audit Data Warehouse to track recovery audit activities thereby preventing duplication of reviews. However, the database was not designed to provide information on all possible duplication, and its data are not reliable because other postpayment contractors did not consistently enter information about their reviews. CMS has not provided sufficient oversight of these data or issued complete guidance to contractors on avoiding duplicative claims reviews.

- Communication Between Recovery Auditors and Providers is Flawed:CMS requires auditors to include certain content in correspondence with providers, but requirements are not always clear and vary across contractor types. Contractors vary in their compliance with their requirements. CMS’s oversight of correspondence varies across contractors, which decreases assurance that contractors consistently comply with requirements. In the correspondence reviewed, GAO found high compliance rates for some requirements, but low compliance rates for requirements about communicating providers’ rights, which could affect providers’ ability to exercise their rights.

- Current CMS Coordination Strategies Should be Improved: CMS has strategies to coordinate contractors’ activities; however, these strategies have not led to consistent requirements across contractor types or full coordination between contractors.

CMS concurred with the findings of the report and plans to improve CMS oversight and guidance as a result.

The report was requested by Sen. Ron Wyden (D-Oregon), Finance Committee Chairman; Sen. Orrin Hatch (R-Utah), Finance Committee Ranking Member; Sen. Tom Carper (D-Delaware), Homeland Security and Governmental Affairs Committee (HSGAC) Chairman; Sen. Tom Coburn (R-Oklahoma), HSGAC Ranking Member; Sen. Chuck Grassley (R-Iowa), Judiciary Committee Ranking Member; Sen. Claire McCaskill (D-Missouri), HSGAC Subcommittee on Contracting Oversight Chairwoman; Sen. Bob Corker (R-Tennessee); Rep. Fred Upton (R-Michigan), Energy and Commerce Committee Chairman; Rep. Henry A. Waxman (D- California), Energy and Commerce Committee Ranking Member; Rep. Charles Boustany, M.D. (R-Louisiana), Ways and Means Subcommittee on Oversight Chairman; Rep. John Lewis (D-Georgia), Ways and Means Subcommittee on Oversight Ranking Member; and Rep. Dianna DeGette (D-Colorado), Energy and Commerce Subcommittee on Oversight and Investigations Ranking Member.

###

(WASHINGTON, D.C.) – More than 600 illegal immigrant detainees released by the Immigration and Customs Enforcement(ICE) in February 2013 have previous criminal convictions, according to a new report from the Department of Homeland Security (DHS) Inspector General. ICE released over 2,000 illegal immigrant detainees in February 2013. The report containing the findings of the investigation, conducted at the request of Senators Tom Coburn (R-OK) and John McCain (R-AZ), was released today.

“It is baffling how an agency charged with homeland security and immigration enforcement would knowingly release hundreds of illegals with criminal histories. In this single action, ICE undermined its own credibility, the rule of law, and the safety of Americans and local law enforcement,” Dr. Coburn stated. “This report provides more evidence that our nation’s immigration laws are being flagrantly disregarded. Americans need to be assured the problems within ICE that led to the dangerous release of illegal aliens will be fixed and DHS and ICE will never again violate the law by releasing known criminals into our streets.”

“This report confirms the Obama administration’s lack of coherent leadership on immigration policy,” Senator McCain said. “The safety of our border communities shouldn’t be put at risk because ICE officials decide to release detainees—many with criminal records—in order to solve their budget problems without waiting to see if they could obtain more funding.”

The Inspector General cited a number of problems at ICE that led to the detainee release, including ICE’s executive leadership’s failure to effectively communicate with the DHS Secretary and the White House about its fiscal challenges or plan to release the detainees. ICE did not notify the DHS Secretary about plans to release or prepare for the potential consequences of releasing 1,450 detainees over one weekend. The DHS Inspector General’s report warns ICE still has not developed a strategy to effectively manage its detention program.

###

A billionaire’s fantasy island, Emmy award winning producers, Goldman Sachs, Broadway music from Hollywood, Starbucks, and even dolphins benefited from a tax credit intended to help struggling communities and lower income Americans seeking new opportunities.

“Banking on the Poor,” a new report released today by Senator Tom Coburn (R-OK) reveals the federal New Markets Tax Credit program is benefitting big banks and private investors that are claiming more than $1 billion of the credit annually.

The program was created to spur new markets, but is instead subsidizing the same old companies and corporations in little need of taxpayer assistance, like Wall Street banks and fast-food chains and luxury hotels. It is also providing financing for unnecessary and silly projects such as a sculpture in the desert, a vintage car museum, and doggie days cares. In at least one case, a project supported with a New Markets Tax Credit is threatening to bankrupt an entire town and eliminate jobs, including the entire police department.

“The New Market Tax Credit is a reverse Robin Hood scheme paid for with the taxes collected from working Americans to provide pay outs to big banks and corporations in the hope that those it took the money from might benefit,” stated Senator Coburn. “When government picks winners and losers, the losers usually end up being taxpayers. Washington should reduce federal taxes on working Americans and all business owners who create jobs by eliminating tax earmarks, loopholes, and giveaways like the New Markets Tax Credit.”

The New Markets Tax Credit program was expected to steer private financing into low-income communities to help create jobs. Yet, virtually every neighborhood, from Beverly Hills to the Hamptons, could qualify for the program. “As a result of the definition of qualified low-income communities, virtually all of the country’s census tracts [neighborhoods and communities] are potentially eligible for the NMTC,” according to the nonpartisan Congressional Research Service.[i]

While some of the projects are well intended, like health clinics, it is still difficult to measure if these tax expenditures are truly helping those seeking a hand up or simply subsidizing banks, corporations, and others companies that are already succeeding.

The program duplicates over 100 other federal economic development efforts. There are at least 23 community development tax expenditures costing taxpayers over $10 billion annually and 80 overlapping discretionary programs costing $6.5 billion annually, 28 of which are specifically designed to spur growth in new markets. Because of this redundancy, many projects and corporations are double dipping on taxpayers—receiving multiple federal subsidies through other grant programs and tax giveaways. Furthermore, it is unclear which of these best meets the overlapping goals, or if any of them spur more economic growth than policies encouraging private investments that do not spend taxpayer money.

A separate Government Accountability Office report issued today, also critical of the New Markets Tax Credit program, revealing:

- The fees charged by the CDEs reduced the amount of assistance provided to low-income community projects by $619 million (7.1 percent) from 2011 to 2012;

- A majority of NMTC-financed projects utilize more than one source of public funding, despite the purpose of the tax credit being to leverage private investment;

- Nearly two-thirds (62 percent) of New Markets projects received other public funding from 2010 to 2012; and

- New Markets investors are able to claim the tax credit on the equity provided by the other public sources.

WASHINGTON – Today, the Chairmen and Ranking Members of the Senate and House committees on government oversight sent a letter to Office of Management and Budget Director Shaun Donovan in light of serious concerns that certain Offices of Inspectors General are experiencing problems obtaining documents from their respective agencies. Senate Homeland Security and Governmental Affairs Committee Chairman Tom Carper (D-Del.) and Ranking Member Tom Coburn (R-Okla.) together with House Oversight and Government Reform Committee Chairman Darrell Issa (R-Calif.) and Ranking Member Elijah Cummings (D-Md.) requested that Director Donovan take “affirmative steps to ensure that all agencies and their staffs are properly informed and trained on the requirements of the Inspectors General Act so that IGs receive the information they need to do their jobs.”

“We write to express our grave concern about difficulties that certain Inspectors General have encountered in trying to obtain documents from their respective agencies,” the Members wrote to Director Donovan. “Timely and complete access to information is essential if Inspectors General are to perform their missions, and their rights to information are clearly provided for in the Inspector General Act of 1978. We call on you to underscore this important fact and enlist your office to help ensure that agencies comply.”

The text of the letter is below:

August 8, 2014

Shaun L. Donovan

Director

Office of Management and Budget

301 G Street, S.W.

Washington, D.C. 20024

Dear Director Donovan:

We write to express our grave concern about difficulties that certain Inspectors General (IG) have encountered in trying to obtain documents from their respective agencies. Timely and complete access to information is essential if Inspectors General are to perform their missions, and their rights to information are clearly provided for in the Inspector General Act of 1978. We call on you to underscore this important fact and enlist your office to help ensure that agencies comply.

Earlier this week, we received a letter signed by 47 of the federal IGs raising serious concerns about difficulties some have faced receiving documents needed for their work. In particular, the letter (attached) details problems encountered by the respective Inspectors General for the Environmental Protection Agency, the Justice Department and the Peace Corps. This is not the first we have heard of these problems. Our offices have already spent time working with the affected IGs in an effort to try and help them gain the needed information. Indeed, Chairman Issa and Ranking Member Cummings examined some of these concerns during hearings before the House Committee on Oversight and Government Reform this year.